Uncategorized

Free Advice On gold as an investment

Retirement Plan and IRA Required Minimum Distributions FAQs

3 The recipient parties transfer the money into az gold documents. What Is the Investment Minimum to Open a Gold IRA Account. Although a minimum investment is required to open a gold IRA account with Regal Assets, it charges a flat annual fee for their services and storing of gold at your behest. American Hartford Gold offers multiple gold coins and silver, similar to other gold IRAs https://reviewjournal.com mentioned. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U. These companies allow new clients to set up gold IRAs within a few days or less and offer qualified assistance from investment professionals. If you’re a beginner with precious metal IRA or are eager to learn more about the rollover process, you can download a free guide on the company’s website. PRIVACY STATEMENT: Any information that you provide us about yourself through this website will be used solely for the purpose for which it is provided and will not be given to any non affiliated third party except as is necessary to accommodate your request, or as may be required by law or legal process. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Updated: 20 May 2023 10:18 am.

Software and Business

Lear Capital is one of the best gold IRA companies, earning an impressive rating for its exceptional customer service and wide range of gold investment options. However, most individual companies do. The vault at Fort Knox is used to store a large portion of the United States’ gold reserves as well as other precious items belonging to or in custody of the federal government. One of the major concerns with gold and silver investments is that they are less liquid than traditional stocks or bonds. This program helps ensure that clients receive all of the benefits they expect from their new investment without having to worry about paying high fees up front. Every customer will work directly with one of Patriot Gold Group’s owners, providing a personalized experience. Investors should consider the annual maintenance fee of $100, the storage fee of either $100 or $150 depending on whether you opt for non segregated or segregated storage, and a $40 paper statement fee if you choose to receive physical statements. The company lists respect, education, and personal attention as its core customer service values.

Email Alert Sign Up Confirmation

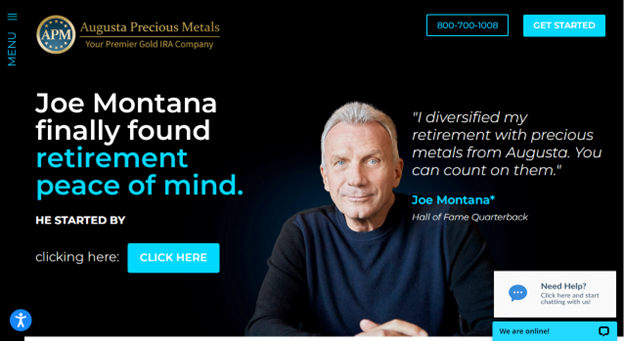

An Oxford Gold Group account manager can answer your questions and help you open one of three types of IRAs: a SEP gold IRA, traditional gold IRA or a Roth gold IRA. Investing in gold is a popular choice for retirement accounts, and many people choose to add gold to their IRA. Today, the name is used to describe firms that accumulate an inventory of precious metals and sell it to coin dealers, jewelers, or investment companies. Experience Gold Investing with American Hartford Gold Group Get Started Now. While the Congress remained singularly focused on the target right from the start, the BJP was busy digging its own grave, hurtling from one misadventure to another. Montana has now become an ambassador for the company. Additionally, a gold IRA can help you overcome financial situations by using the money from your IRA to pay off debts or other expenses. You can hold four types of precious metals in your gold IRA: silver, gold, platinum, and palladium. Augusta Precious Metals is a precious metals marketplace that allows you to buy and sell gold, silver, platinum and palladium. Additionally, it’s important to consider fees and storage options, as these can vary widely between companies. That’s where gold IRA custodians come in. Noble Gold is a California based, privately owned company that focuses on asset and wealth security.

Welcome to Invesco Netherlands

BBB: A+ From 72 Reviews. We offer two types of buybacks. Difficult to get clear pricing information on physical gold purchases. Instead of having every employee be an expert at everything about the industry, they have five different teams. The company’s philosophy is that informing customers of their upfront expenses helps them be better prepared for their investment journey. You will work with a single person throughout the entire process. Content sponsored by Carbon Collective Investing, LCC, a registered investment adviser. Their customer service is exemplary, providing prompt and helpful responses to any questions. Precious metals are sought after because they have intrinsic value — although their prices can fluctuate, especially in the near term. Discover the Value of Augusta Precious Metals: Invest in Quality and Security Today. It’s currently a leader in attracting noble gold investments, especially from retirees who are eager to convert their retirement funds into safe gold backed IRAs. Gold IRAs usually come with a few one time account setup fees and a few annual fees. Due diligence today will ensure you’re working with the best gold IRA company for 2023.

Pros and Cons of Gold IRAs

Patriot Gold Group: Best selection of precious metals. Getting started requires a $25,000 minimum investment, and you can usually roll over funds into your IRA within two weeks. What to look out for: You’ll need at least $25,000 to set up an IRA and purchase gold. These are also known as precious metals IRAs. Once you’ve paid for your gold or silver coins and shipping, you’ll receive your precious metals and can store them wherever you want — in a safe, at a bank, or even under your bed. Noble Gold is our top recommendation for small investors looking to venture into precious metals IRAs because they have minimum investment requirements and extensive educational resources for customers. Goldco made it so simple for me to rollover my 401k and answered all of my questions and more. “Augusta Transaction Agreement,” Page 3. The company has a BBB rating of A+. Try Gold Alliance Today Unlock Your Potential and Take Your Business to the Next Level.

Hezbollah Stages Show Of Force In Lebanon

Several online resources provide ratings and reviews of precious metals IRA companies, which can be useful in evaluating their reputations and legitimacy. GoldBroker is a top rated gold IRA company for its superior customer service and wide range of gold investment options. They are a reliable and trustworthy source for gold investments, offering competitive fees and a wide selection of precious metals. Refer to a professional for investment advice. In certain situations, however, or when you missed the closing date due to unforeseen or unavoidable circumstances, the IRS could waive the tax and fine or extend the two month deadline. Additionally, gold IRAs are subject to certain IRS rules, so it is important to be aware of these rules before investing. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. GoldStar Trust Company is a $2 billion division of Happy State Bank based in Texas. Diversification does not guarantee a profit or protect against loss in a declining financial market. Discover what an average 401k return is and how asset allocation can affect how your retirement savings perform. IRS rules for precious metals IRAs state that the precious metals must be shipped to an approved IRA depository. On the other end of the spectrum, companies that charge outrageously high fees may not be trustworthy either. When you acquire precious metal IRAs, the responsibility of storing these valuable metals falls on you. Noble Gold focuses on the importance of gold for protecting your wealth and your future.

Gold Alliance: IRA Accounts Best Gold IRA Companies

You don’t have to wait for American Hartford Gold’s newsletter to know how your investment is performing. However, they do have an investment guide that has some more information. You can then fund your gold IRA by rolling over assets from an existing retirement account such as a 401k, 403b, TSP, or IRA. Others, such as GoldCo and Advantage Gold, focus more specifically on gold IRAs. They can give personalized advice and letcha know which option would work best given your unique situation – whether it be investing in gold or something else entirely. These are the most challenging factors to detail, as prices in the precious metal world can change rapidly. © 2023 Adam Enfroy Ventures LLC, 7542 Excitement Drive, Reunion, FL 34747. STRATA Trust Company STRATA is a wholly owned subsidiary of Horizon Bank SSB and is regulated by the Texas Department of Banking.

Finding A Broker Or Custodian For Your Gold Based IRA

Some custodians offer limited protections. Thomas Brock, CFA®, CPA, is a financial professional with over 20 years of experience in investments, corporate finance and accounting. There are six major factors to consider when evaluating potential custodians for your Gold IRA. The process involves transferring the funds from the existing account to a new gold IRA account. In line with making sure that first time precious metal investors have enough information before hopping in, Advantage Gold has a team of professionals charged with the following roles. If you want to contribute to a Roth IRA, your Modified Adjusted Gross Income MAGI must be less than $140,000 for the tax year 2021 and $144,000 for the tax year 2022 if you file taxes as a single person; and it must be less than $208,000 for the tax year 2021 and $214,000 for the tax year 2022 if you’re married and filing jointly. It is important to carefully review the fees and charges involved to ensure that you understand the costs and how they will impact your overall investment returns. There are a lot of gold IRA companies out there, and not all of them are legitimate. The American Hartford Gold Group is a trusted leader in the gold IRA industry, offering top notch service and expertise to their clients. The company says it’s focused on its clients by offering high levels of communication and several forms of educational content.

Company Reputation

Gold And Silver Metals. This is one of the key reasons that clients find this company highly attractive. There is a $25,000 preferred minimum initial investment to open a gold IRA with Goldco. Gold and silver were among the first known investments and served as a form of currency for centuries. One of the most important is whether or not there are any fees associated with such an investment. If you like the personal touch, Birch Gold Group may be the best gold IRA company for your needs. You’ll avoid immediate taxes and your retirement savings will continue to grow tax free.

Key features:

Oxford Gold Group Cons. A: There are several benefits of a gold IRA, including the potential to grow your retirement savings, diversify your portfolio, and hedge against inflation. The company also prides itself on its transparent pricing and secure storage solutions. The depository is based both in the United States and Canada. Reviews have consistently praised the attentive and professional staff at American Hartford Gold. If you hold your gold for longer than one year, the only tax you pay is capital gains on the profit from the sale. But with so many companies promising amazing results and failing to deliver, it can be difficult to know which one to trust. Experience the Quality of Augusta Precious Metals: Invest in Value Today. It is important to research and understand the risks before investing. What makes this company stand out. When you open a precious metals IRA account with Augusta Precious Metals, you get access to the company’s knowledge base, which is packed with information about how gold investing works.

Low Minimum

We have successfully gone through the five best gold IRA companies. Augusta Precious Metals requires a minimum order of $50,000 for any purchase, whether for an IRA or cash account. Purchasing physical gold or silver for your savings is an important decision. Ideally, a good retirement oriented portfolio will mix stocks, bonds, and index funds, in the right balance with bank accounts, cash investments, and other potential growth investments. Consequently, a loss may be suffered with respect to the Trust’s precious metal that is not covered by insurance. The company is dedicated to providing superior customer service, offering competitive pricing and a wide selection of investment options.

We value your feedback

Augusta Precious Metals stands out among the competition with its commitment to excellent customer service. Regardless of the name, your precious metal IRA should still be diversified storage with 5 10% of it being composed of precious metals. They even offer educational videos, including “10 Big Gold Dealer Lies” and “15 Bad Reasons to Buy Gold,” to help customers make informed decisions. You’ll see the guy on TV from time to time talking about Rosland Capital. Home » What is a Gold IRA and How Does it Work. Their wide selection of gold IRA products and services, combined with their knowledgeable team of professionals, make them an ideal choice for those looking to invest in gold. Experience the Difference with GoldCo: Invest in Quality Today. A gold IRA rollover guide can provide step by step instructions on how to open a gold IRA, as well as the risks and benefits associated with investing in gold. The ability to make a confident yet informed investment decision can be made through investor education. What’s more, Augusta’s incredible team will complete 95% of the paperwork work with you, making everything clear, quick, and consistent. Finding the right broker or custodian for gold investments in IRA is important. Discover the Benefits of Investing in Noble Gold Today.

Precious MetalsInvestment Guide

Investing in gold isn’t for everyone. As someone who has been researching and investing in precious metals for several years, I can confidently say that Augusta Precious Metals is one of the best companies in the industry. These fees can range from a few hundred dollars per year to several thousand dollars, depending on the value of your IRA and the type of metals you hold. They can help you to set up your account and to select the best gold investments for your needs. You’ll also benefit from the convenience of being able to invest online without having to leave home or visit a physical location. Investing in gold can be a wise decision to diversify a portfolio that is mainly made up of risky assets such as stocks, cryptocurrencies, or real estate. First, the best method of survival as an investor is always diversification. Depending on your financial condition, you can deduct donations from your income on your tax return.

Should you roll your 401k into a gold IRA?

This form only takes about five minutes to complete. According to the Better Business Bureau BBB, Goldco has received positive reviews from its clients, with an average rating of 4. Discover What Birch Gold Group Offers. Make sure to research and choose a trusted custodian and be aware of any fees they may charge. Gold IRAs cater to investors who want to add diversification as they save for retirement. What Assets Can Be Held In A Precious Metals IRA. Why we like Birch Gold GroupFrom your very first call, Birch Gold Group matches you with a precious metals specialist. Invest in Physical Gold and Silver with GoldBroker. To make things even better, they offer a free educational seminar to help you learn more about investing in gold and silver. Easily unsubscribe anytime. Once it’s funded, Patriot will help you buy the coins and manage it automatically. Colin Shipp is compensated for referring traffic and business to these companies. According to IRS regulations, self directed IRAs can hold alternative investments such as precious metals. The amount of the fees varies depending on the custodian and the services they provide.

Philly Weekly Staff

Though you may feel an urgency in setting up your gold IRA account take your time and perform due diligence. Setup fees: Most gold IRA companies will charge a once off setup fee to open a new precious metals IRA and may charge an extra fee to handle a 401k or IRA rollover. This means any profits taken out of the account during retirement could potentially qualify for lower taxes compared to other sources of income such as wages or dividends paid by stocks and bonds. The list of their services is quite considerable, but what you have to remember is that the custodian is primarily charged with investing in assets for you. They promise to buy back your gold at the current market value, minus a small administrative fee. Oxford Gold Group is acclaimed for its gold investment expertise, presenting an extensive array of gold IRA services, such as gold IRA rollovers, transfers, and investments. Q: What are the best gold IRA companies to work with. This can be done with the help of a financial advisor or a gold IRA custodian. Once your account is set up, you can begin buying gold and other precious metals. The price of cryptocurrency is typically more volatile than that of gold.

Benefits

This precious metal IRA company offers a wide range of selection of gold, silver, platinum, and palladium coins and bars that are approved by the IRS for holding in a precious metal IRA account. First and foremost, it’s important to note that this gold IRA company is considered a leading IRA choice in the precious metal industry – for a reason. You can also make annual contributions to your IRA based on the limits set by your category of IRA and your age. It has a buyback guarantee, providing peace of mind that you have a reliable gold IRA company for your gold in case of early liquidation. This ranking system allowed investors to make an informed decision when choosing a gold IRA company. When it comes to customer service, they take the time to understand each investor’s unique financial goals and tailor their recommendations accordingly. It has transacted over $3 billion in precious metals investments in the past 20 years and offers long term assistance with your gold or silver IRA. While some top rated precious metals IRA companies may offer a free first year of storage, it’s crucial to evaluate their other costs before making a decision. Thomas Brock, CFA®, CPA, is a financial professional with over 20 years of experience in investments, corporate finance and accounting. Gold also has a long history of being used as a currency, which makes it a popular choice for investors looking to hedge against inflation.

Jordan J

To learn more about them and their fees, charges, etc. That said, no matter which type of Gold IRA you choose—it’s essential to understand all the applicable tax laws beforehand so you don’t get caught off guard down the road. Augusta Precious Metals is one of the best gold IRA companies. Also, be mindful of what fees they are charging you for maintaining the IRA. Maximize Your Investment Potential With Augusta Precious Metals Today. Keeping your new gold coins or silver coins at home is also an option with Noble Gold. One can find these gold IRA reviews online, but even more helpful are the feedback forums you’ll find in local communities. Liquidating some or all your precious metals or doing an in kind distribution and taking possession of them is a simple process.

Warning

The IRS details regulations regarding the storage of any physical gold, silver, platinum, or palladium that backs an IRA. Augusta Precious Metals is a gold IRA company that offers competitive rates and a range of services for its customers. Gold IRA reviews can help investors determine which type of gold is best suited for their individual needs. If you buy physical gold and decide to sell it, the gold will be converted instantly to cash at the current per ounce price of gold. Also, monitor the investments and make necessary changes as they arise, especially as your goals change when retirement draws closer. However, the IRS does not allow gold IRA holders to keep their precious metals in their homes. In addition to the ones on this list, we are creating comprehensive reviews of all the top gold IRA firms around the country. Discover the Benefits of GoldCo: Invest Now for Maximum Returns. With gold now back near record highs and people wrongly, in our view touting it as an inflation or uncertainty hedge, gold IRAs are getting a lot of attention right now. In conclusion, investing in gold is a great way to protect your retirement account against market volatility and inflation. Gold IRAs allow investors to own physical gold, silver, platinum, and palladium, as well as other precious metals.